Investing in solar is a given for many real estate professionals looking to become more sustainable. More and more real estate companies are turning to rooftop solar panels to meet their climate-friendly goals — and earn dividends.

But what’s not as straightforward a decision? How to maintain those solar assets for optimal performance, risk mitigation, and return on investment.

Omnidian’s Sr. Director of Commercial Enterprise Sales, Genevieve Gravina, recently joined Michael Beckerman on the CREtech podcast to discuss the opportunities around solar and battery storage for real estate investors, developers, owners, and operators.

Here’s what they talked about:

Push for Adoption of Solar on Real Estate Rooftops

As real estate companies increasingly look to solar thanks to tailwinds from the Inflation Reduction Act (IRA), they’re weighing the benefits against the investment on top of their building(s).

For starters, Genevieve said solar provides financial benefits. Properties of real estate investors, developers, and portfolio managers have an estimated 3.5 billion square feet of roof space available for solar generation. And a report by Morgan Stanley estimated that on-site solar would be “in the money” or cheaper than buying electricity from the grid for 90% of the top 50 REITs by 2025, and would result in revenue accretion of 3%.

Genevieve also noted solar is a perfect way for companies looking to become more sustainable and reach key environmental, social, and governance (ESG) milestones. “If you’re looking to make a big impact on your ESG goals — like using the combination of renewable energy generation and other methods like protecting the thermal envelope of your building and upgrading your systems — then solar can make a really big impact in combination with other efforts,” she said.

While many top companies are implementing solar across their properties, there’s still the opportunity for investment by those in the wider real estate space who haven’t yet made the leap into solar.

Connect With a Performance Assurance Specialist

Solar Asset Management Made Easy

For real estate companies that haven’t invested in the renewables space, mitigating risk is key to safely investing in solar. How can property tech (aka proptech) partners like Omnidian help reduce risk and avoid unnecessary loss for companies that have never had solar installed on their real estate assets before?

“My takeaway is partners with these real estate companies because while these organizations excel at building value in real estate, they might often lack the expertise, the resources, and the knowledge to manage their solar asset(s),” Michael said.

Omnidian helps companies manage solar and mitigate risk by:

1. Reducing Operating Expenses While Increasing Uptime Through Proprietary Technology

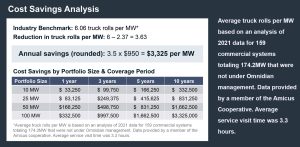

Omnidian helps reduce operation and management (O&M) operating costs, especially around costly truck-rolls and unplanned maintenance. We do this through rapid and actionable issue detection and diagnosis through our purpose-built technology, providing root-cause classification.

Click to enlarge

When compared to industry standards*, our clients see a 60% reduction in truck rolls and the associated operating expenses. *Source: Amicus O&M Cooperative

“Solar asset owners are investing hundreds of thousands of dollars into a given system. They’re looking for a partner to provide monthly performance reports that show them how the system’s reporting against predicted versus expected models,” Genevieve explained.

2. Providing a Single Point of Contact

She also noted real estate owners/operators are looking for a single point of contact if there’s an issue to coordinate downstream activities. For example, they need someone to show up at the site within a reasonable timeframe to keep the system up and running, helping alleviate the responsibilities of ownership tied to a valuable investment like solar on their property.

“Omnidian has a field service network that we vet and make sure all of their insurances are in place and ensure they have the appropriate licenses, so when there is an issue on site, we can deploy to over 33,000 ZIP codes across the nation,” Genevieve explained.

“This allows us to have a unified scope of services — a unified preventative maintenance scope — ensuring the quality of the work that’s being done. We manage all of that versus your team having to go out and find an O&M provider in San Francisco, one in Florida, and one in Montana. We provide all of those downstream activities through our field service network.”

Ultimately, Omnidian customers have “peace of mind knowing there’s a long-term plan for operations and maintenance,” Genevieve said.

Whether you already have solar assets under management, or are just in the feasibility stage, you deserve a partner purpose-built to help protect your renewable investments.

And we’re ready to help you do that.